The End of the Lithium Bull Market?

The fundamental enabling technology for electric cars is lithium-ion. In the absence of that, I don't think it's possible to make an electric car that is competitive with a gasoline car.

Elon Musk

Why another paper on lithium?

I wrote about lithium only a few months ago. In “How DLE Will Change the Lithium Industry” (see here), I argued that, although the new extraction method called DLE will raise extraction costs, the much higher output when deploying DLE will more than compensate for that. However, as I also pointed out, DLE is only an option for those companies that extract lithium from brine pools – not an option for lithium miners.

To continue reading...

Worldwide, brine pools account for nearly two-thirds of all lithium reserves but only 40% of all lithium extractions. South America is the world force on brining, and most South American lithium brining takes place in an area known as the Lithium Triangle, which is situated on the border between Bolivia, Argentina and Chile. The Lithium Triangle holds the largest lithium reserves worldwide. Traditional mining is the prevailing extraction methodology in the rest of the world.

In the paper on DLE, I argued that, in the years to come, briners will be able to establish a meaningful advantage over miners and, therefore, that investors should favour briners over miners when investing in lithium extraction companies. Frustration levels with our lithium portfolio have therefore been meaningful over the past few months, as virtually all lithium extraction companies have performed poorly. Hence the question – is the bull story on lithium over?

Why has lithium performed so poorly recently?

Most commodities are characterised by having only one or two principal grades and one or two prices that dominate (e.g. Brent and WTI in oil markets); however, when it comes to lithium, there is a wide spectrum of grades and a myriad of prices (Exhibit 1).

Lithium extraction companies have performed poorly over the summer in an otherwise strong stock market. It is indeed tempting to blame the weakness in lithium equities on the declining commodity price, but that doesn’t bring me any closer to a meaningful conclusion. In search of the underlying reasons why lithium has disappointed over the summer, I can think of at least three:

1. The ongoing economic slowdown in China.

2. The planned ‘nationalisation’ of the lithium industry in Chile.

3. Extraordinarily strong performance prior to the current sell-off.

Source: Goldman Sachs Global Investment Research

I could even add a fourth reason – the possibility that, sooner or later, lithium will be replaced by another material – but have chosen not to do so. If you think of the current state of the battery market, it is not unreasonable to compare it to the aviation industry in the early parts of the 20th century, after the Wright brothers made history in 1903 with the first powered flight.

The aviation industry has changed dramatically since, and I believe the battery industry will undergo a similar, revolutionary change. At some point, another more energy-efficient material will most likely replace lithium; however, according to a battery industry insider I have talked to, that is at least 10-15 years away.

Source: counterpunch.org

Our bullish stance on lithium explained

Before I go into the three underlying reasons why lithium has disappointed this year, I should spend a minute on why we turned bullish in the first place. Our view is probably best illustrated with a simple chart – see Exhibit 2 above.

Large amounts of green metals shall be required to complete the conversion to renewable energy sources. As I frequently point out, six of those green metals are in serious, short supply. Exhibit 2 illustrates how much shall be needed of each of those six metals to complete the renewable infrastructure vs. proven reserves. Although I recognise that actual reserves are probably a fair bit higher than proven reserves, I don’t think actual reserves are anywhere near big enough to support the green transition, which is a must if we want to meet our NetZero target.

As you can see, lithium is one of the six green metals in short supply, and I continue to believe that the six metals in question could be about to enter a supercycle of quite extraordinary proportions. It is therefore only fair to ask – why hasn’t our game plan worked out as the textbooks prescribe?

Adding to that, recent developments to do with a new battery type – the so-called Solid-State Battery (SSB) – has turned me even more bullish on lithium. If you haven’t already read it, I suggest you read the October Absolute Return Letter which you can find here. Our October letter provides more information on SSB and why it is likely to become the next big thing. The rise in demand for lithium from SSB has not been incorporated into the numbers in Exhibit 2.

The ongoing economic slowdown in China

Now to the reasons why lithium has underperformed more recently. China is in dire straits economically – at least by their standards. I have done a fair bit of work on China over the last few weeks and have concluded that the problem, first and foremost, is excessive debt in many municipalities and provinces around the country. Central government debt is actually quite low, but most investment projects are run locally – not by the central government in Beijing. Therefore, excessive debt levels at the local level will hold back new investments and thus economic growth.

Secondarily, high debt levels in the private sector have exacerbated the problem. Whilst household debt is not excessive, corporate debt levels certainly are, and that has further limited the appetite for new investments. A mountain of debt, and the rising cost of it, has resulted in a meaningful slowdown in economic activity. China is not about to enter a recession (I think) but, when you are used to 5-7% annual growth, 3-4% feels like a recession. One cannot rule out that the helping hand from Beijing will have an instant impact, but my base case outcome remains one of relatively low economic activity for several more months, and that will, in the near term, continue to have a meaningful impact on the lithium price.

China holds 7-8% of worldwide lithium reserves; however, 65-70% of lithium extractions worldwide are consumed by the Chinese (source: Statista). Most of the lithium consumed in China is used by lithium-ion battery makers, six of which are among the top ten in the world (source: The Meghalayan). It is therefore only reasonable to expect that a slowdown in economic activity in China will have a meaningful impact on the lithium price.

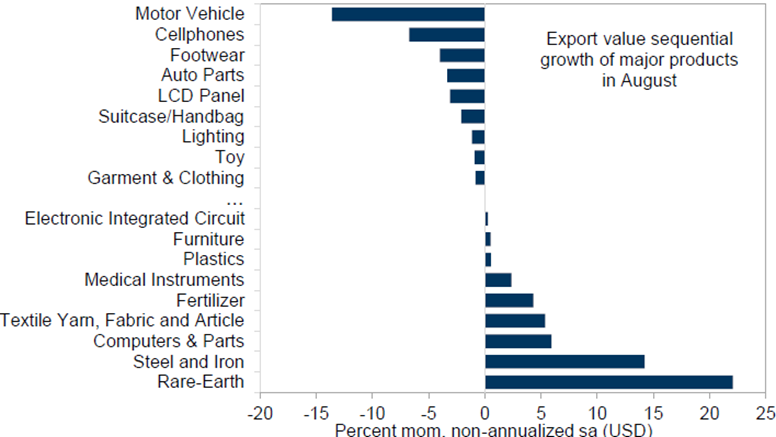

Source: Goldman Sachs Global Investment Research

Furthermore, as you can see in Exhibit 3 above, it is not only in China that activity levels have declined more recently. Chinese exports of cars and smartphones – the two industries that consume the most lithium – declined significantly during the month of August. Exports of steel and iron, on the other hand, increased notably, which may suggest that we have now passed the low point in economic activity worldwide.

The planned ‘nationalisation’ of the lithium industry in Chile

Chilean President, Gabriel Boric, announced back in April that Chilean lithium extractors will have to work in partnership with the government in exploiting Chile's vast lithium reserves. International investors reacted overwhelmingly negatively to that and saw it as a first step towards nationalisation. Having said that, I suggest you read my comments on President Boric’s proposal, which you can find here. You will see that what Boric proposed is not at all what I would characterise as a first step towards nationalisation.

In early May, Boric’s left-wing government suffered a crucial defeat in the elections for the national assembly. The far-right Republican Party won a majority and stripped Boric of most of his powers. He remains President of Chile but can’t do much on his own anymore. Since election day, all the talk about ‘nationalising’ the lithium industry in Chile has turned remarkably quiet, which is undoubtedly a function of Boric’s waning powers; however, in investor circles, the damage has been done. Investors assume it is only a question of time before Chile is again under the control of the labour party.

I don’t have much new to add on top of what I said back in May. However, I should point out that Chile is the second largest producer of lithium worldwide, behind Australia. A nationalisation proper would probably have rather dramatic implications; however, I really don’t think that is what is on Boric’s drawing board. I have discussed this with Chilean lithium company executives, who have all the reasons to be sceptical, but they were actually quite upbeat about the prospects of working more closely with the government. As one of them said, “after years of uncertainty, this provides very clear guidelines as to what we can and cannot do.”

Extraordinarily strong performance prior to the current sell-off

Given the two setbacks already mentioned – the economic slowdown in China and the risk of nationalisation in Chile – one shouldn’t be surprised that many investors have chosen to cash in on earlier profits. As you can see in Exhibit 4 below, from April 2020 to the peak in November 2021, lithium investors made their money back almost five-fold – it was quite an extraordinary 18 months.

Source: Google Finance

As you can also see, it has been mostly downhill since late 2021, probably for the reasons mentioned above. When the Chinese slowdown and the drama in Santiago started to unfold, many investors sat on some extraordinary profits from 2020-21. When profits come easy, the tendency is to realise those profits, should bad news materialise, and I suspect that has also been a contributing factor more recently.

The latest from the research laboratories

Only a couple of months ago, Toyota took everybody by surprise when it announced that, in 2027, the company will roll out a new type of battery – an SSB – which can drive about 1,200 km (750 miles) between charges and is capable of recharging in only ten minutes. Even better, the SSB is non-flammable – unlike lithium-ion batteries which burst into flames occasionally.

A few weeks later, another interesting story popped up on my monitor. Two Swiss engineers have established a company called BTRY (pronounced “battery”) and are developing (they say) the rechargeable battery of the future – a solid-state, thin-film battery. The two Swiss engineers claim their new battery can run up to ten times longer between charges than current lithium-ion batteries, and that it can be fully recharged in one minute. Like Toyota’s SSB, it is non-flammable.

My first reaction was “wow”, quickly followed by “how will this affect our investments in lithium?”, so I started to dig deeper. My worries about the SSB technology and how it could negatively impact demand for lithium turned out to be unfounded. Solid-state batteries use about 35% more lithium than lithium-ion batteries. They will require less of certain other metals, e.g. cobalt and graphite, but demand for lithium will definitely increase. There can be no doubt that if the numbers claimed by Toyota and BTRY are anywhere near correct, SSB is the way forward – for EVs as well as smartphones, tablets and laptops.

This poses another challenge. Could the world run out of lithium reserves in the middle of the green transition? Going back to Exhibit 2 for a moment, as you can see, even before the introduction of SSB, we were likely to come up against this problem sooner or later; however, there is some good news to report on that front too. Recent research reports suggest that we are getting better at recycling lithium (see here).

At first glance, you may argue that this can’t be good for the lithium price but, according to a quick, back-of-the-envelope analysis I have done on this issue (see the appendix for details), demand for lithium will still dramatically outstrip supply. Even if all outstanding lithium-ion batteries are recycled, aggregate demand from EVs, laptops, tablets and smartphones, driven by the rapidly growing middle classes of the developing world, will be more than sufficient to drive lithium prices substantially higher.

What next?

The conclusions I am about to make are based on the following assumptions, not all of which have been discussed in this paper; however, they should still be familiar to ARP+ subscribers, as they have been covered in other research papers in the recent past.

1. In most developed countries, the car fleet will go almost fully electric over the next 15-20 years.

2. SSBs will gradually replace lithium-ion batteries over the next 5-10 years.

3. Whether lithium-ion or SSB prevail, lithium will be the fuel of choice in rechargeable batteries for many years to come.

4. The first commercial fusion reactor will be introduced between 2030 and 2035, and lithium is also the fuel of choice in fusion reactors.

5. The introduction of DLE will benefit lithium briners over lithium miners.

6. Chile will, at some point increase the level of cooperation between the government and the privately-owned lithium industry, but nationalisation it isn’t.

7. Although Chinese economic growth will continue to be sub-par for several more months, we are close to the low point in the economic cycle.

Given those assumptions, and given that most of the bad news referred to in this paper is already priced in (I think), I recommend that investors:

a. maintain any existing exposure to lithium, although it could take a few months before returns become satisfying again;

b. establish an exposure to lithium at current price levels, if one is not already in place;

c. favour briners over miners.

The third recommendation creates a conflict for investors, concerned about political events in Chile. Three countries stand to benefit more than anyone from DLE – Bolivia, Argentina and Chile, as they control the Lithium Triangle between them. Bolivia, although it may hold the biggest reserves worldwide, is a bit of a basket case, when it comes to taking advantage of the lithium opportunity. Argentina faces its fair share of problems too. That leaves Chile, where we have made most of our lithium investments so far. However, if you think nationalisation of the lithium industry in Chile is a real possibility, you shouldn’t invest there. Then, suddenly, there is not much to invest in within the lithium brining industry.

Risks

As readers of my work will be aware, in late July, I reduced the probability of recession over the next 12 months – a recession that has been predicted by so many but that actually looks less and less likely for every day that passes. You can see ARP’s most recent recession forecasts in Exhibit 5 below. That said, we are not totally out of the woods yet. Should a recession strike over the next 6-12 months, now would not be the best time to invest in lithium.

Source: Absolute Return Partners LLP

The other risk I am concerned about is the extensive research going into other battery technologies. The chances are that, sooner or later, someone will come up with an alternative to lithium – something both better and cheaper. I don’t have enough insight into what goes on in research laboratories around the world to quantify this risk, which makes me slightly uncomfortable. In that context, suffice to say that I have to rely on the intelligence I have access to – that there is nothing in the pipeline for at least the next 10-15 years.

Niels

19 October 2023

Appendix

Why recycling lithium won’t harm the lithium price

The 23 countries that, according to World Economics, make up the developed world have 966 million inhabitants between them. As we passed eight billion worldwide less than a year ago, we can assume that the rest of the world add up to a tad over seven billion. I note that China alone has about 1.4Bn inhabitants, almost 50% more than the whole of the OECD put together.

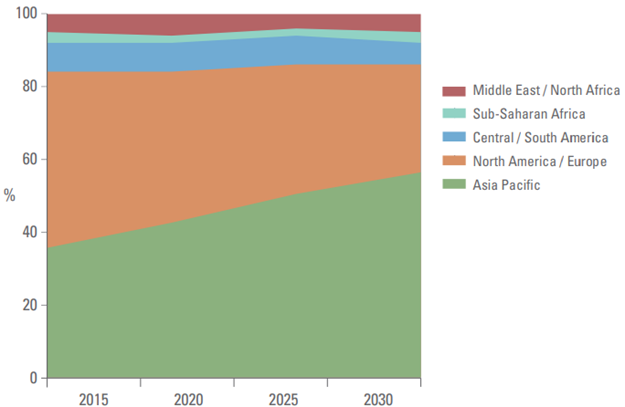

When living standards improve, more money is spent on what I call middle-class items. Living standards are indeed improving in many EM countries and nowhere more profoundly than in Asia. There are approx. 4.5Bn people in Asia today. According to the OECD, in 2009, middle-class spending in EM countries made up 25% of global consumption. By 2030, that number is expected to increase to nearly 70%, and Asian middle-class spending will, according to the OECD, make up almost 60% of the 70% (Exhibit A1).

Sources: OECD, Ashmore Group

Cars are a prime example of a middle-class item finding its way into Asian households. The Asian car fleet is growing rapidly. There are already 543Mn cars on Asian roads; however, on a per capita basis, Asia is still years behind Europe and North America. With only 0.14 vehicles per capita, when they reach European standards (0.52 vehicles per capita), another 1.6Bn cars will be driving around on Asian roads (source: Hedges & Co.). It is only a question of time before that happens.

Source: hedgescompany.com

Of the approx. 1.5Bn private cars on the roads today worldwide, only 2.1% are electric, but that number will grow fast in the years to come. It is also worth noting that demand for lithium to be used in cars is growing even faster than demand for electric cars, reason being that demand for bigger cars (e.g. SUVs) is growing faster than demand for smaller cars. Bigger cars require bigger and more powerful batteries.

In other words, if we have about 1.5Bn cars on the world’s roads today, of which about 300 million are electric, if we are looking at a future with almost 3Bn cars on the roads, and if most of those additional cars will be electric, even if lithium can be recycled, it is a drop in the ocean compared to the increased need for lithium.

Admittedly, I made one important assumption when putting my bull case argument forward. I assumed that history repeats itself, i.e. that Asians will be attracted to the same lifestyle items as Europeans and Americans, as standards of living in Asia improve. That means more cars but also more mobile phones, more tablets and more laptops in circulation, all of which shall require lithium to function; however, I see no reason not to make that assumption.